Record a Journal Entry in QuickBooks Desktop 4 Easy Steps

Contents:

Click the arrow next to Reminder List in the upper right and select Run Report to see the Recurring Template List Report. You create recurring transactions and post the transaction files for them in theVantagepoint Transaction Center. For more information, seeSetting Up Recurring Transactions. In QuickBooks, even if all transactions are entered in a general journal, you can still generate journal entries when you have the required tools.

- For example, if you paid a check to someone, you would typically do that with the New button on the left-side Navigation Pane and selecting Bill from the Vendors category.

- Choose another account from the Account dropdown and enter the same amount you debited from the first account into the Credit field.

- Moreover, it is important for you to us the accounts receivable or accounts payable account on the second line of the journal entry.

- First of all, Click the Import available on the Home Screen.

- These are perfect for transactions with the same dollar amount each time.

Yes, multiple users can create and edit journal entries if they have the necessary access rights in the user permissions settings. An “Admin” or a user with “Full Access” can manage journal entries. Can’t locate the journal entry I created can see I did it in audit log but can’t search it…it’s called Shopify sales and for incoming dep and fees for online orders. While reconciling an account or digging in for any errors, you must check all old journal entries in your QuickBooks.

How to merge customers in Quickbooks

On the other side of the equation, the liability account, which is Bond Payable, will receive a $50,000 credit. So, the balance sheet will have a $50,000 increase on both sides, keeping the equation equal. A balance sheet shows your company’s assets, liabilities, and equity at a certain point in time. Assets refers to the things your company owns and which produce revenue. Liabilities are what your company owes to others and includes accounts payable and debt. Equity is difference between assets and liabilities, and is often considered the true value of a business.

You will get a reminder ahead of each occurrence so you can make any necessary changes before sending. Squire provides complete and personalized accounting solutions to meet your individual needs. Outsourcing your bookkeeping is more affordable than you would think. We save you money the moment you hire us by cutting out the expensive cost of hiring an in-house CFO.

How to Create Recurring Transactions in QuickBooks Online?

To import the data, you have to update the Dancing Numbers file and then map the fields and import it. Still, If you get stuck anywhere, It is highly recommended to hire a professional for such an issue. Or you can connect with Dancing Numbers team via LIVE CHAT for all your recurring transactions problems in QuickBooks Online. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Online.

That will give your clients wholesale rates, lower than if they click the button while logged in as themselves. Now that we have bank feed automation, you’re usually better off making Banking Rules instead, since they take into account variations in dollar amount and date. It’s easier than editing Reminder transactions, or fixing duplicates if the amount happened to be different.

A Guide to Setting Up Automated Billing for Your Business – The Motley Fool

A Guide to Setting Up Automated Billing for Your Business.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

It is not possible to automate bill payments or deposits. After a recurring transaction is created, you can select the frequency and type. A Recurring Transaction is a particular characteristic of QuickBooks Online, which enables you to design transaction templates and then use them again. After you automate routine transactions, you will be able to save time that is usually wasted in repetitive data entry.

Browse by type

I create Sales Receipts that occur automatically on the 1st of the month, run my clients’ payment, and email their receipt. Because I use QuickBooks Payments, the sales even batch deposit themselves. My monthly billing cycle for 75 clients takes me exactly 0 minutes, every month. Note that you can’t use Recurring Transactions for Invoice Payments or Bill Payments, because they are second stage.

A budget journal entry affects only adjusted budget balances. The adjusted budget type cannot be modified to include other entry types. Now double click the journal entry and then, choose the delete or void option and hit OK button. In case you are required to delete or void a journal entry, the below steps need to be carried out. You need to first visit the company menu and then choose the make general journal entries option. Let’s say you have a customer who wants to rent a printer from you for one year.

How to Reverse a Journal Entry?

Also, in it, you will have to mention the total amount for the recurring journal entry that you have decided. Once you’ve created recurring transactions, you have several options for managing them. If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. First of all, Click the Import available on the Home Screen. For selecting the file, click on “select your file,” Alternatively, you can also click “Browse file” to browse and choose the desired file.

Once you have logged into your account, you will be able to find the “Journal Entries” option. This option will take you to the journal entry page where you can create and manage your journal entries. You will be able to add and edit items, enter dollar amounts and apply tax codes when making journal entries. Once you have completed the journal entry, save it and it will be available in the “Journal Entries” tab of your QuickBooks account. In QuickBooks Online you can create templates for recurring transactions, like recurring expenses.

You can create a new recurring journal entry or create a recurring journal entry from a posted journal entry. The types of recurring journal entries count on the nature of the business. There are a few accounting heads that every business follows.

Choose another account from the Account dropdown and enter the same amount you debited from the first account into the Credit field. Journal entries are not required for most transactions. Usually, you will want to use QuickBooks Online’s native tools to do things like pay bills or make deposits, rather than using journal entries. A potential journal entry can easily be converted to any other type of journal entry. Choose a journal entry type from the F4 drop-down list.

Let’s see how you can use a Journal Entry to show depreciation of an asset. For this example, let’s take $100 out of one account and put it into another. On the first line, pick an account from the Account dropdown and the enter $100 into the Debits field.

Make sure that the same amount you debited in line 1 is in this line’s Credits column. This and the Description field should be filled in automatically by QuickBooks Online for you. For a basic entry, you will take money out of one account and put it into another. To restrict transactions within a date range, enter the Start Date and Stop Date fields. In the Reference field, type a reference ID for the journal entry of up to six characters.

Xero Accounting Software Review 2023 – The Motley Fool

Xero Accounting Software Review 2023.

Posted: Tue, 14 Mar 2023 07:00:00 GMT [source]

To make an estimate a recurring transaction, switch to the old experience. In the footer of the form, select Make recurring to create a template . If you opened an invoice, instead select Automation, then Recurring invoice. UnscheduledSaved with partial or complete data and without a schedule. Nothing happens to this type of template until you choose to use it. The merchant service fees are cheaper for ProAdvisors® than they are when business owners sign up themselves.

After this, when a month begins, these entries get automatically recorded in the accounting software. Journal entries that are recurring are related to certain transactions, expenses, etc. In a specific accounting period, these entries are found to be repeated. In certain cases, these entries can carry information relating to allocations, accruals, amortization, and depreciation.

botkeeper or uncheck the boxes next to Cards and Bank Transfer in the Online Payment section to do this. Being able to allocate a percentage when memorizing a transaction isn’t an option,wkdchung. You use Merchant Services, determine if your customer can pay you online.

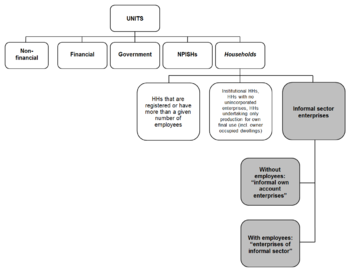

When transferring money from an asset, liability, or an equity account to the income or the expense account. At the time of sending the money between income and expense accounts. You are recommended not to make journal entries to inventory or payroll accounts.